Introduction: The Enigma of Jared Vennett

In the star-studded 2015 film The Big Short, Ryan Gosling’s portrayal of the slick, fast-talking Deutsche Bank trader Jared Vennett captivated audiences worldwide.

With his sharp suits and sharper wit, Vennett embodied the brash confidence of Wall Street in the lead-up to the 2008 financial crisis.

But who is the real person behind this enigmatic character, and how closely does Hollywood’s depiction align with reality?

This article delves deep into the world of Jared Vennett, exploring his real-life counterpart and the intricate web of events that led to one of the most significant economic downturns in modern history.

We’ll uncover the truth behind the silver screen and examine the lasting impact of both the fictional character and the man who inspired him.

The Big Short: A Cinematic Powerhouse

Before we dive into the specifics of Jared Vennett’s character, it’s essential to understand the context of the film that brought him to life. The Big Short, directed by Adam McKay, hit theaters in December 2015 and quickly became a critical and commercial success.

Based on the non-fiction book by Michael Lewis, the film offers a scathing yet darkly comedic look at the events leading up to the 2008 financial crisis.

The movie boasts an impressive ensemble cast, including:

- Christian Bale as Dr. Michael Burry

- Steve Carell as Mark Baum

- Ryan Gosling as Jared Vennett

- Brad Pitt as Ben Rickert

Released by Paramount Pictures, The Big Short grossed over $133 million worldwide and earned numerous accolades, including the Academy Award for Best Adapted Screenplay.

The film’s success can be attributed to its ability to break down complex financial concepts for a general audience while maintaining a compelling narrative.

Who is Jared Vennett?

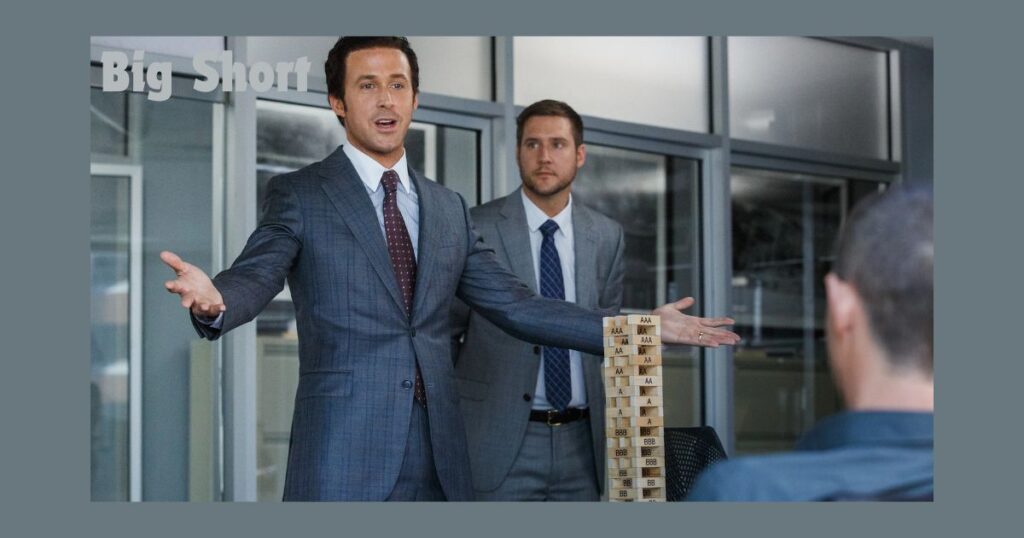

In the context of The Big Short, Jared Vennett is portrayed as a Deutsche Bank trader who recognizes the impending collapse of the U.S. housing market.

He’s depicted as a smooth-talking, opportunistic character who sees a chance to profit from the looming disaster by selling credit default swaps.

Vennett serves as both a narrator and a key player in the film, breaking the fourth wall to explain complex financial instruments to the audience.

His character is crucial in connecting the various storylines and helping viewers understand the intricacies of the subprime mortgage crisis.

Is Jared Vennett Based on a Real Person?

Yes, Jared Vennett is indeed based on a real person. The character is inspired by Greg Lippmann, who was the global head of asset-backed securities (ABS) trading at Deutsche Bank during the financial crisis.

While Hollywood took some creative liberties in adapting Lippmann’s story for the big screen, many of Vennett’s key characteristics and actions are rooted in reality.

Read This Post: CaseOh Weigh

Greg Lippmann: The Man Behind the Character

Greg Lippmann is the real-life Wall Street trader who served as the inspiration for Jared Vennett. During the lead-up to the 2008 financial crisis, Lippmann played a significant role in betting against the housing market through credit default swaps.

According to Bloomberg, he made an estimated $1.5 billion for Deutsche Bank by offsetting losses on mortgage investments with these bets against subprime debts.

Greg Lippmann’s Background

To understand the man behind the character, let’s take a closer look at Lippmann’s background:

- Born and raised in New York City

- Attended the University of Pennsylvania, where he studied economics and English

- Began his career at Credit Suisse in 1991, where he became a director and head of ABS and CDO trading

- Joined Deutsche Bank, where he worked as a trader of non-investment grade ABS and residential mortgage-backed securities (RMBS)

- In 2003, became the global head of ABS and collateralized debt obligation (CDO) trading at Deutsche Bank

Lippmann’s expertise in complex financial instruments and his prescient understanding of the housing market’s vulnerabilities positioned him to make significant profits during the financial crisis.

Lippmann’s Role in the 2008 Financial Crisis

During his time at Deutsche Bank, Lippmann became increasingly concerned about the stability of the U.S. housing market.

He recognized that many subprime mortgages were at risk of default and that the complex financial instruments built on these mortgages were fundamentally unsound.

Lippmann’s strategy involved:

- Identifying vulnerable mortgage-backed securities

- Purchasing credit default swaps to bet against these securities

- Convincing others to take similar positions, effectively shorting the housing market

His actions were controversial at the time, with many colleagues and industry peers dismissing his concerns. However, as the crisis unfolded, Lippmann’s bets proved to be incredibly profitable for Deutsche Bank.

What Has Greg Lippmann Done Since The Big Short?

After the financial crisis, Lippmann’s career took a new direction:

- Left Deutsche Bank in April 2010

- Co-founded LibreMax Partners with Fred Brettschneider, former Deutsche Bank head of global markets

- Started managing $900 million at LibreMax, which has grown to manage $8.6 billion as of 2022

- Currently serves as portfolio manager and chief investment officer at LibreMax

In addition to his work in finance, Lippmann has also become involved in philanthropic efforts:

- Serves on the board of the South Fork Natural History Museum

- Member of the advisory council of the American Museum of Natural History

How Did Greg Lippmann Feel About Being Played by Ryan Gosling?

When asked about Ryan Gosling portraying him in The Big Short, Lippmann had a positive reaction. He humorously stated:

“There’s a lot less appealing people to play you in a movie than Ryan Gosling. If one of the sexiest men alive plays you in a movie, it’s hard to complain about that.”

This response showcases Lippmann’s sense of humor and his ability to take the Hollywood adaptation of his life in stride.

The Legacy of Jared Vennett/Greg Lippmann

The story of Jared Vennett and Greg Lippmann has had a lasting impact on both finance and popular culture:

- Increased public understanding: The Big Short helped demystify the complex factors that led to the 2008 financial crisis for a general audience.

- Ethical debates: Lippmann’s actions sparked discussions about the ethics of profiting from economic downturns.

- Financial industry reforms: The crisis led to new regulations and a reevaluation of risky financial practices.

- Cultural impact: The film’s success brought renewed attention to the real-life events and people involved in the crisis.

Read This Post: Miami Heat vs Boston Celtics match player stats

Conclusion: Fact vs. Fiction in The Big Short

While Hollywood took some creative liberties in adapting Greg Lippmann’s story for The Big Short, the core elements of Jared Vennett’s character remain true to life.

Both the real and fictional versions recognized the impending collapse of the housing market and took controversial steps to profit from it.

Understanding the real stories behind Hollywood adaptations like The Big Short is crucial for gaining a more nuanced view of complex historical events.

Greg Lippmann’s experiences during the financial crisis offer valuable insights into the workings of Wall Street and the g consequences of financial decision-making.

As we reflect on the legacy of Jared Vennett and Greg Lippmann, it’s clear that their stories continue to resonate in both finance and popular culture.

They serve as a reminder of the power of foresight, the complexities of global economics, and the enduring impact of those who dare to go against the grain.

Installing the Hitv Mod Apk can seem like a daunting task, but worry not! With this step-by-step guide, you’ll have it up and running in no time. We’ll walk you through everything you need to know, from preparation to the final installation. Whether you’re a tech newbie or a seasoned pro, this guide is designed to be simple and straightforward. Let’s dive right in!

FAQ’s

What is Jared Vennett’s role in The Big Short?

In The Big Short, Ryan Gosling portrays Jared Vennett, a slick salesman from Deutsche Bank. Vennett seizes the opportunity to sell Michael Burry’s credit default swaps to profit from the looming housing market collapse.

The character of Jared Vennett is based on Greg Lippmann, a key figure in the real-life events surrounding the financial crisis.

Who is Jared Vennett based on in real life?

Jared Vennett, played by Ryan Gosling in The Big Short, is not a real name but is based on Greg Lippmann. Lippmann was a hedge fund manager and a Deutsche Bank executive who led the global asset-backed securities trading team.

After learning about Michael Burry’s prediction of the housing bubble, Lippmann decided to sell swaps, capitalizing on the impending market crash.

Who are the real people behind The Big Short characters?

The main characters in The Big Short are inspired by real-life figures. Michael Burry, portrayed by Christian Bale, is a real hedge fund manager.

Steve Carell’s character, Mark Baum, is based on investor Steve Eisman. Jared Vennett (Ryan Gosling) draws from Greg Lippmann, while Brad Pitt’s character, Ben Rickert, is based on Ben Hockett, a former trader who aided Jamie and Charlie with their investments.

Hello, I’m Dan Brown, a writer at Matchplayerstat. I explore the dynamic world of players and celebrities, delivering captivating insights and updates. Join me on Matchplayerstat.com for the latest in player stats and celebrity news.”